When it comes to steering the economy, Central Banks hold the reins. Let's talk about how they do it.

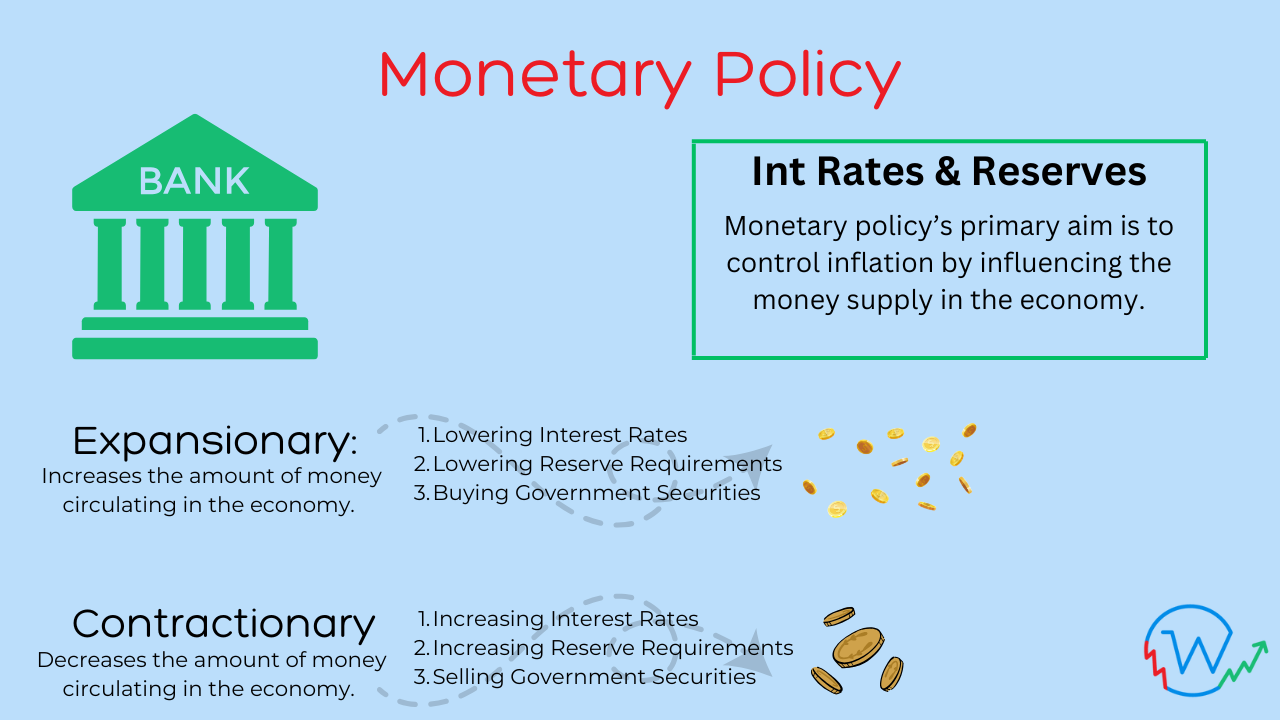

What is Monetary Policy

Monetary policy refers to the strategic actions taken by a country’s central bank to influence the availability and cost of money in the economy. Its primary goal is to maintain economic stability by managing inflation, encouraging employment, and fostering sustainable growth.

In practical terms, central banks—like the Federal Reserve in the United States or the Bank of Canada—use monetary policy to regulate interest rates, control the money supply, and stabilize the financial system. These institutions act as the economy’s guardians, ensuring that it doesn’t overheat (leading to high inflation) or freeze (causing a recession).

Monetary policy can be categorized into two main types:

- Expansionary Monetary Policy: Used during economic slowdowns to stimulate growth by lowering interest rates or increasing the money supply. This makes borrowing cheaper and encourages spending.

- Contractionary Monetary Policy: Implemented to curb inflation during periods of rapid growth. By raising interest rates or reducing the money supply, it discourages excessive borrowing and spending.

In essence, monetary policy serves as the central bank’s toolkit for achieving a balanced and healthy economy.

Role of Central Banks

Central banks play a pivotal role in modern economies, acting as the cornerstone of financial stability and economic policy. Here’s a closer look at their responsibilities:

- Monopoly Suppliers of Currency

Central banks are legally designated as the sole providers of a country’s currency. In the past, this currency was often backed by tangible assets like gold under the gold standard. For instance, before 1931, the Bank of England’s notes could be exchanged for a fixed amount of gold. However, most economies abandoned this system during the 20th century. Today, currencies are fiat money, meaning they hold value not because they are backed by physical commodities but because they are recognized as legal tender and widely accepted in exchange for goods, services, and debt repayment. - Overseeing the Payments System

Central banks ensure that a country’s payment system—the network enabling transactions and money transfers—operates efficiently and securely. They establish robust and standardized procedures to minimize disruptions and risks. In an increasingly interconnected world, central banks also coordinate internationally to harmonize payment systems across borders, ensuring smooth global financial operations. - Managing Foreign and Gold Reserves

Central banks are the custodians of a country’s foreign exchange and gold reserves. These reserves act as buffers for economic stability, allowing central banks to intervene in currency markets, stabilize exchange rates, and support international trade. - Monetary Policy Management

The most visible and impactful role of central banks is shaping monetary policy. By setting interest rates, controlling the money supply, and deploying various tools, they steer the economy towards key objectives like stable inflation, employment growth, and overall financial health.

In essence, central banks serve as both the architects and guardians of the economic and financial systems, ensuring stability, trust, and growth within the economy.

Arguments in Favor of Monetary Policy

Monetary policy was introduced as a structured approach to manage economic stability during the turbulence of the early 20th century. It emerged in response to the need for centralized mechanisms to address economic volatility, particularly after the global financial instability of the Great Depression. Before this, economic management relied heavily on gold-backed currency systems and informal policy measures, which proved insufficient during crises.

Early Advocates of Monetary Policy and Their Arguments

Prominent economists and policymakers such as John Maynard Keynes and Milton Friedman were influential in shaping the understanding and advocacy of monetary policy. Keynes, through his seminal work in The General Theory of Employment, Interest and Money, argued that government intervention, including monetary tools, was necessary to manage aggregate demand and prevent prolonged economic downturns. Friedman, while emphasizing the control of the money supply, reinforced the idea that a steady and predictable monetary policy could stabilize inflation and foster economic growth.

Early arguments for monetary policy centred on its ability to:

- Prevent Bank Runs and Financial Crises: The central bank, as the lender of last resort, could provide liquidity during financial panics, reducing systemic risks.

- Stabilize Inflation: By managing money supply and interest rates, monetary policy could prevent runaway inflation or deflation.

- Encourage Economic Growth: Controlling borrowing costs through interest rate adjustments could incentivize investments and consumption during economic slowdowns.

These arguments were instrumental in the establishment of central banks, such as the Federal Reserve in 1913, which institutionalized monetary policy as a key economic tool.

Evidence of Monetary Policy’s Success

Over the decades, monetary policy has demonstrated its efficacy in addressing many of these early concerns:

- Taming Inflation: The control of inflation in the 1980s, often referred to as the “Volcker Shock,” showcased the power of monetary policy. By aggressively raising interest rates, the Federal Reserve under Paul Volcker brought double-digit inflation down to manageable levels, setting the stage for decades of economic stability.

More on Volcker Shock

Under Federal Reserve Chairman Paul Volcker, the U.S. adopted aggressive monetary policies to combat inflation, which had reached over 14% in 1980.

Volcker’s strategy involved tightening monetary policy by significantly raising interest rates, which reduced consumer spending and business investment. Although this approach triggered a severe recession, it successfully reduced inflation to below 5% by 1983, proving the efficacy of a committed, credible monetary policy in shaping market expectations. This period is detailed in books such as The Volcker Disinflation in The Monetary Policy of the Federal Reserve and the Federal Reserve Bank’s analysis of the era. Check out these articles at the Federal Reserve Bank and Cambridge for more information.

- Mitigating Recessions: During the 2008 Global Financial Crisis, central banks worldwide used monetary tools such as quantitative easing and interest rate cuts to stabilize financial markets and stimulate economic recovery.

More on Mitigating Recessions

Monetary policy is also critical in softening the impact of economic recessions. Central banks often lower interest rates and engage in quantitative easing (injecting money into the economy) to stimulate growth.

Books like The Alchemy of Finance by George Soros explore how monetary tools are employed to stabilize economies during downturns. Another helpful read is Lords of Finance by Liaquat Ahamed, which delves into how central bank policies shaped economic recovery during historical crises like the Great Depression.

- Promoting Employment: Policies targeting lower interest rates have often been tied to periods of robust job creation and reduced unemployment.

Current Arguments for Continuing Monetary Policy

Today, monetary policy remains a cornerstone of economic governance, and its continuation is argued on several fronts:

- Economic Stabilization: With globalization and interconnected markets, monetary policy helps buffer national economies against external shocks.

- Flexibility and Speed: Unlike fiscal policies, which often require legislative approval, monetary tools can be implemented quickly to respond to economic changes.

- Low Inflation and Growth Balance: Monetary policy ensures a delicate balance between fostering economic growth and keeping inflation under control.

- Adapting to New Challenges: Issues like cryptocurrency, digital payments, and global financial crises demand the adaptability that modern monetary policy offers.

In summary, monetary policy has evolved from a necessity during economic turbulence to an essential tool for modern economic management. Its continued use is justified by its proven ability to stabilize economies, prevent crises, and adapt to an ever-changing global financial landscape.

Books Supporting Monetary Policy

The Little Book of Economics explains economic principles, including monetary policy, in simple and relatable language. Greg Ip uses real-world examples to demonstrate how tools like interest rates and money supply affect the economy.

Key Features:

- Explains the role of central banks in managing inflation and recessions.

- Provides historical anecdotes, making complex concepts easy to understand.

Ideal For: Readers new to economics who want a clear, practical introduction to monetary policy.

Principles of Economics is widely used in introductory economics courses and includes clear, straightforward explanations of monetary policy and its effects on inflation, unemployment, and economic growth.

Key Features:

- Chapters on monetary policy are concise and easy to digest.

- Includes diagrams and real-world applications to reinforce concepts.

Ideal For: Beginners who want a foundational understanding of economics and monetary policy.

Arguments Opposing Monetary Policy

While monetary policy is widely recognized as a vital tool for economic stability, critics have raised several concerns about its effectiveness, unintended consequences, and long-term implications. These arguments have grown particularly strong during times of economic turbulence or when policies appear to deviate from expected outcomes.

1. Limited Effectiveness During Economic Crises

Critics argue that monetary policy can become less effective in extreme economic conditions, such as during liquidity traps or periods of near-zero interest rates. For example:

- Liquidity Traps: When interest rates are close to zero, further rate cuts may not incentivize additional borrowing or investment, limiting the central bank’s ability to stimulate the economy.

- Over-reliance on Monetary Policy: In severe downturns, like the Global Financial Crisis of 2008, even aggressive monetary measures failed to prevent prolonged recessions without significant fiscal intervention.

2. Risk of Inflation or Deflation

Improper calibration of monetary policies can lead to unintended price instability:

- Hyperinflation Risk: Critics cite cases like Zimbabwe and Weimar Germany, where excessive money printing led to hyperinflation.

- Deflationary Pressure: Tight monetary policies, if poorly timed, can suppress demand and lead to deflation, as seen during Japan’s “Lost Decade” in the 1990s.

3. Inequality and Asset Bubbles

Monetary policy is often accused of disproportionately benefiting wealthy individuals and large corporations:

- Wealth Inequality: Low interest rates and quantitative easing can inflate asset prices, disproportionately benefiting those who own stocks and real estate.

- Asset Bubbles: Prolonged periods of easy money have been linked to speculative bubbles, such as the U.S. housing bubble preceding the 2008 crisis.

4. Loss of Credibility and Independence

Critics fear that monetary policy can be influenced by political pressures:

- Political Interference: In some cases, central banks may face pressure to implement expansionary policies to drive short-term growth, undermining their independence.

- Credibility Issues: Frequent changes in policy direction can erode trust among investors and consumers, destabilizing financial markets.

5. Dependency on Monetary Policy

Over-reliance on monetary policy can mask the need for structural reforms:

- Neglect of Fiscal Policy: Governments may delay necessary fiscal interventions, such as infrastructure investments or tax reforms, expecting central banks to manage economic issues.

- Temporary Fix: Critics argue that monetary policy often addresses symptoms rather than root causes of economic problems, leading to a cycle of repeated interventions.

Books Criticizing Monetary Policy

The Great Deformation critiques modern monetary policy and its role in shaping economic and political systems. Stockman, a former congressman and director of the Office of Management and Budget, argues that excessive monetary intervention distorts market forces, misallocates resources, and leads to unsustainable financial practices.

Key Features:

- Provides a historical analysis of monetary policy and fiscal decisions from the New Deal to the 2008 financial crisis.

- Criticizes the Federal Reserve’s role in enabling economic bubbles and government debt accumulation.

- Advocates for market-based solutions over central bank interventions.

Ideal For: Readers interested in understanding the long-term consequences of interventionist monetary policy on capitalism and governance.

Former Congressman Ron Paul calls for the abolition of the Federal Reserve, arguing that it undermines economic stability and personal freedoms. He critiques fiat currency and monetary policy, advocating for a return to a gold standard and decentralized financial systems.Key Features:

- Explains the history and structure of the Federal Reserve in accessible language.

- Argues that the Fed’s policies lead to inflation, economic inequality, and reduced transparency.

- Presents a libertarian perspective on economic and monetary reform.

Best For: Readers who are skeptical of central banking and interested in alternative economic systems like the gold standard.

Monetary Policy Cheat Sheet