Ever wondered how stimulus checks or infrastructure projects (like public schools) affect the economy? That’s fiscal policy in action.

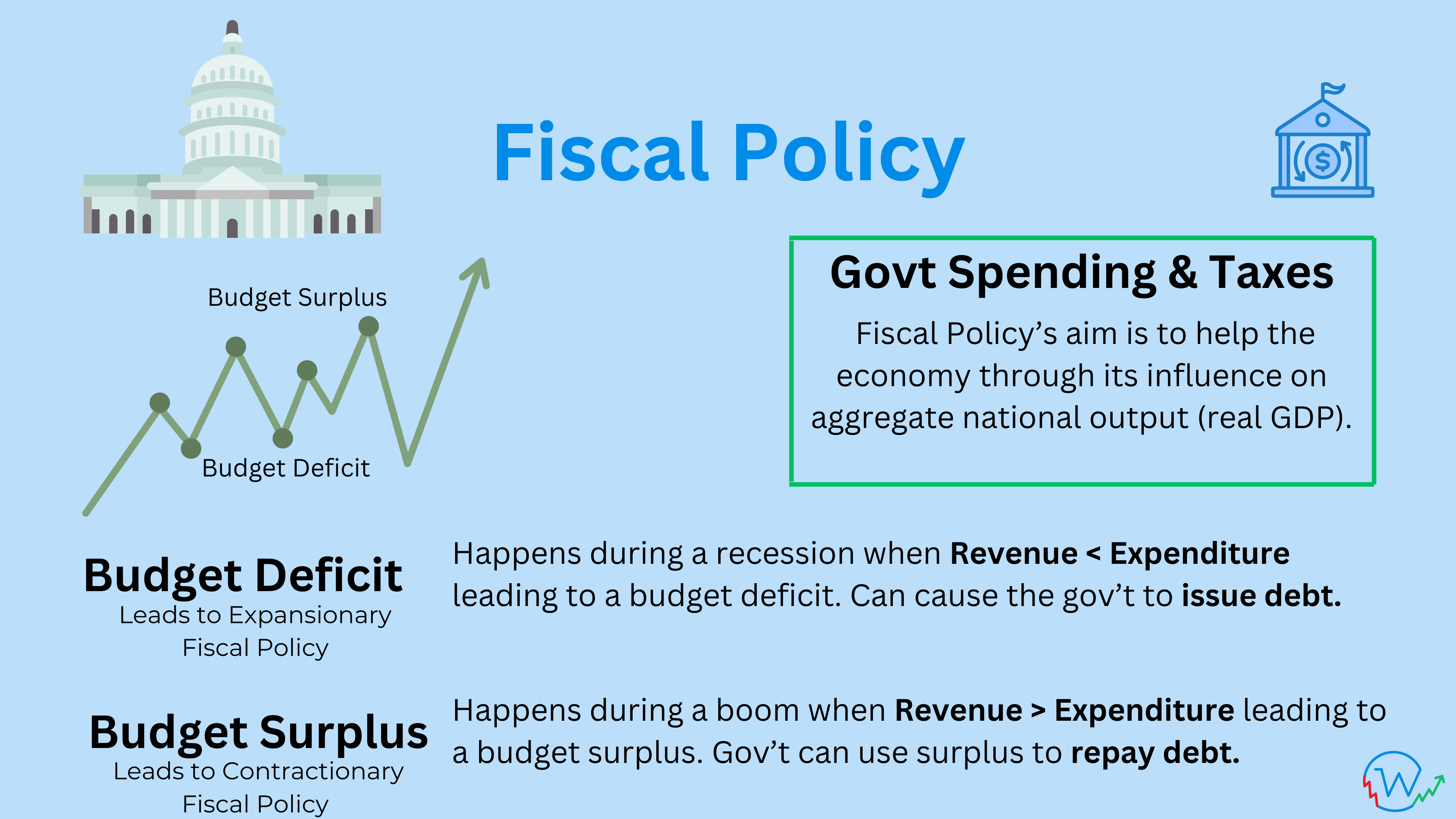

Fiscal policy refers to the government’s use of spending and tax policies to influence economic activity, shape the distribution of income and wealth, and direct resources across sectors of the economy.

In countries like the United States and Canada, fiscal policy is a critical tool for managing the overall level of demand, (or aggregate demand), in the economy. Governments aim to balance economic activity, promote growth, and reduce inequality by adjusting spending and revenue. These decisions aren’t just about numbers – they impact real lives, determining which sectors thrive, who benefits from public services, and how national resources are allocated.

The primary goal of fiscal policy is to manage the economy’s output, often measured as real GDP, and ensure stability during economic fluctuations. While discussions often focus on the changes in government spending versus revenue, rather than their absolute levels, these adjustments profoundly influence economic growth and the financial well-being of citizens.

In this section, we’ll dive deeper into how fiscal policy works, the tools it employs, and the far-reaching effects it has on both the economy and society.

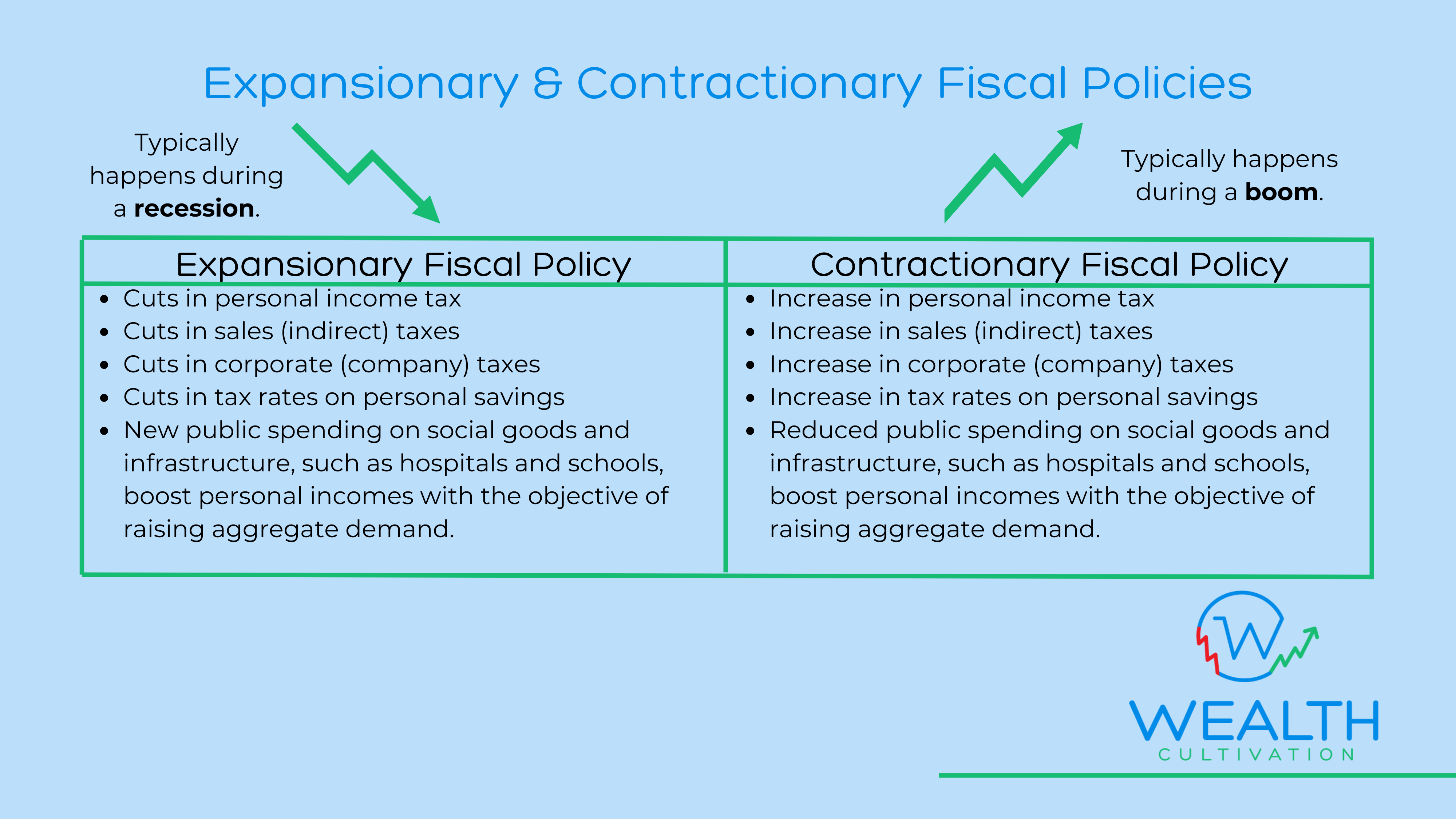

Expansionary & Contractionary Fiscal Policies

As mentioned earlier, fiscal policies are tools that governments use to influence the economy. Depending on the economic situation, they can implement expansionary or contractionary fiscal policies to achieve their goals.

Expansionary Fiscal Policy aims to stimulate the economy during a recession mainly by cutting taxes and increasing government spending (increasing jobs).

Contractionary Fiscal Policy aims to sedate the economy during a boom mainly by increasing taxes and decreasing government spending (decreasing jobs).

A good way to remember this is Expansionary = Increasing jobs and Contractionary = Decreasing jobs. Once you have that memorized, it's only a matter of figuring out when a government should increase jobs - which is obviously during a recession. And when there are plenty of jobs, it makes sense for the government to focus on repaying debt instead of competing with the private sector for employees.

Justifications for Fiscal Policy

“If men were angels, no government would be necessary.”

-James Madison

Fiscal policy serves as a cornerstone for government intervention in the economy, and it has both economic and social justifications.

Of course, there are also opposing viewpoints

“Man is not free unless government is limited.”

-Ronald Reagan

Regardless of the different takes on government, it is safe to say that most people do believe that some level of government is necessary. The debate is often about how much. By leveraging taxation and public spending, governments aim to address pressing societal needs, achieve economic objectives, and ensure long-term stability and growth. Here are the primary justifications for fiscal policy:

1. Providing Public Goods and Services

Certain services, such as national defence, public safety, and law enforcement, benefit almost all citizens (except the ultra-wealthy). Fiscal policy enables governments to fund these essential services.

2. Supporting Economic Growth Through Infrastructure

Investments in infrastructure, such as roads, bridges, and public transportation, are critical for a nation’s economic development. Fiscal policy justifies such spending as it not only creates jobs but also enhances productivity and competitiveness, laying the foundation for sustained economic growth.

3. Redistributing Income and Wealth

Fiscal policy is a powerful tool for addressing economic inequality. Through programs like welfare benefits, unemployment assistance, and progressive taxation, governments can guarantee a minimum standard of living for poorer segments of the population. These measures help to redistribute income and wealth, fostering a more equitable society.

4. Managing Economic Objectives

Governments use fiscal policy to influence key economic objectives, including:

- Low inflation: Controlling public spending and managing demand to prevent excessive price increases.

- High employment: Stimulating economic activity through spending on job-creating projects.

- Sustainable growth: Ensuring that the economy expands steadily without overheating or falling into recession.

5. Encouraging Innovation and Development

High-risk, high-reward sectors such as alternative energy, biotechnology, or advanced manufacturing often require initial subsidies or support to thrive. Fiscal policy justifies funding for research and development in these areas, enabling breakthroughs that can benefit the broader economy while addressing global challenges.

Fiscal Policy Through Taxes

Taxes are one of the most powerful tools of fiscal policy, providing governments with the revenue needed to fund public goods, services, and infrastructure projects. Beyond revenue generation, taxes serve broader economic and social purposes, such as redistributing wealth, influencing consumer behavior, and stabilizing the economy. Fiscal policy uses two primary types of taxes to achieve these goals: direct and indirect taxes.

Direct Taxes

Direct taxes are imposed directly on individuals, businesses, and estates. These taxes are based on income, wealth, or corporate profits and are typically progressive, meaning higher-income individuals and corporations pay a larger percentage. Examples of direct taxes include:

- Income Taxes: These are based on individual earnings and are often a primary revenue source for governments.

- Corporate Taxes: Charged on business profits, influencing investment and growth strategies.

- Property Taxes: Applied to the value of owned properties, including residential and commercial real estate.

- Inheritance Taxes: Collected from the estate of a deceased person, serving both as a revenue tool and a means to redistribute wealth.

Direct taxes are generally designed with equity in mind, ensuring that wealthier individuals and organizations contribute proportionally more to public resources.

Indirect Taxes

Indirect taxes are applied to the sale or consumption of goods and services. Unlike direct taxes, they are not directly tied to income or wealth, making them less progressive but easier to administer. Examples include:

- Sales Taxes (or Value-Added Taxes): Charged on most goods and services, with some exceptions like healthcare and education, to make essentials more affordable.

- Excise Duties: Levied on specific goods, such as fuel, alcohol, and tobacco, often with additional goals like discouraging the consumption of harmful products.

- Gambling Taxes: Designed not only to raise revenue but also to deter excessive gambling due to its potential social harms.

- Fuel Taxes: These often serve dual purposes—raising revenue and promoting environmental sustainability by discouraging excessive fuel consumption.

Indirect taxes influence consumer behavior, encouraging or discouraging certain activities based on societal or environmental priorities.

The Role of Inflation in Tax Revenue

Inflation can inadvertently boost government revenue. As prices rise, so do the revenues from indirect taxes like sales taxes, which are percentage-based. Similarly, inflation can push individuals and businesses into higher income brackets for direct taxes, increasing tax revenue without legislative changes. However, this effect can create economic distortions, such as “bracket creep,” where taxpayers face higher rates despite no real increase in purchasing power.

Balancing Economic and Social Goals

Taxes are more than a means to collect revenue—they reflect a government’s priorities. Direct taxes are often used to promote equity and redistribute wealth, while indirect taxes can target specific behaviors or address societal challenges, such as environmental sustainability. When crafted thoughtfully, tax policies can align with broader fiscal goals, driving economic growth, ensuring fairness, and addressing pressing social needs.

Fiscal Policy Through Government Spending

Government spending is a cornerstone of fiscal policy, serving as a powerful tool to influence the economy’s trajectory. Through targeted expenditures, governments aim to stimulate economic growth, address societal needs, and achieve macroeconomic stability. Here’s how government spending shapes the economy:

Boosting Aggregate Demand

- Government spending directly impacts aggregate demand by injecting money into the economy.

- Infrastructure projects, public sector wages, and procurement of goods and services create immediate economic activity, spurring job creation and business growth.

Addressing Economic Cycles

- In times of economic downturn, governments often increase spending to compensate for reduced private sector activity. This is known as expansionary fiscal policy and is designed to revive economic growth.

- During periods of inflation or overheating, spending may be curtailed (a contractionary approach) to reduce demand pressures.

Infrastructure Development

- Investments in infrastructure, such as roads, schools, hospitals, and public utilities, not only provide immediate economic stimulus but also lay the groundwork for long-term growth by improving productivity and connectivity.

Social Welfare and Redistribution

- Government spending on welfare programs, unemployment benefits, and healthcare services ensures a safety net for vulnerable populations, redistributing wealth and promoting social equity.

Innovation and Strategic Development

- Public funds are often allocated to research and development (R&D) in sectors like renewable energy, technology, and healthcare. Such spending supports innovation and addresses high-risk areas that private investors may avoid.

Challenges with Government Spending

While government spending plays a vital role in fiscal policy, it is not without its criticisms and challenges:

- Risk of Inefficiency: Mismanagement or corruption can result in funds being wasted or misallocated.

- Deficit Spending: Excessive spending can lead to higher national debt, raising concerns about fiscal sustainability.

- Crowding Out: Increased government borrowing can drive up interest rates, potentially discouraging private sector investment.

By strategically deploying public funds, governments have sought to manage economic stability, promote growth, and address pressing societal challenges. However, the effectiveness of such measures depends on their timely implementation, transparency, and alignment with broader economic goals.

Books in Favor of Fiscal Policy

Here are three books that explore and support fiscal policy, providing detailed discussions on its theory and application, particularly in the context of economic stabilization and growth:

The Deficit Myth by Kelton provides a progressive perspective on fiscal policy, advocating for a more significant role of government spending to address social and economic challenges. The book challenges conventional thinking about deficits and promotes using fiscal policy for long-term economic benefits

Criticisms of Fiscal Policy

“There are no solutions, only trade-offs.”

-Thomas Sowell

There are many economists that claim that fiscal policy does more harm than good. From delays in implementation to the risk of ballooning debt, fiscal policy has its share of critics. Below will be criticisms about both of the two tools of fiscal policy – taxations and spending.

Criticisms About Fiscal Taxation

The Fiscal Tax Policy, a cornerstone of fiscal strategies, often attracts significant debate due to its complexities and impact on various stakeholders. Here are some key criticisms:

1. Impact on Incentives

One major criticism is that income taxes can dampen incentives to work, save, and invest. Economists, especially proponents of supply-side economics like Arthur Laffer, argue that high tax rates discourage productivity. For instance:

- Work Effort: Higher income taxes may dissuade individuals from seeking additional work or promotions, reducing overall labor participation.

- Savings and Investment: The claim is that heavy taxation on income and capital gains might deter savings and business investments, slowing economic growth. However, evidence on this is mixed. While some studies observed a rise in business investments following tax cuts, others found little to no correlation.

2. Fairness of the Tax System

The fairness of tax policy is another contentious issue. Evaluating the tax burden across different income groups reveals disparities:

- Progressivity: The U.S. federal tax system is highly progressive, with higher-income groups bearing a larger tax burden. However, critics argue that the actual distribution of tax benefits and burdens can be unclear due to data limitations and varied interpretations of “fairness.”

- Economic Inequality: Changes in tax laws often spark debates about whether they exacerbate or mitigate income inequality, with some reforms appearing to favor wealthier individuals.

3. The Need for Tax Reform

Tax policy frequently undergoes scrutiny for its complexity and perceived inefficiencies. Key areas of debate include:

- Flat-Rate Taxes: Advocates argue that a uniform tax rate on labor income could simplify the system, while critics fear it might disproportionately impact lower-income groups.

- Corporate Tax Adjustments: Proposals to allow immediate deductions for investments or alter dividend taxation often raise questions about their long-term effects on corporate behavior and economic growth.

- Consumption Taxes: Shifting revenue sources from income to consumption taxes could encourage savings but might burden lower-income households more heavily.

- Inflation Indexing: Failing to index taxes to inflation can lead to “bracket creep,” where individuals face higher taxes despite no real increase in purchasing power.

- Estate Taxes: The debate continues over whether taxing inherited wealth is fair or whether it penalizes family success and perpetuates wealth inequality.

Broader Implications

Critics of fiscal policy argue that poorly designed or implemented tax policies can hinder economic efficiency, distort resource allocation, and fail to achieve social equity goals. They emphasize the importance of balancing revenue generation with fairness and economic incentives.

This criticism underscores the complexity of fiscal policy and the necessity of transparent, data-driven approaches to optimize its effectiveness while minimizing unintended consequences.

Criticisms of Fiscal Spending

We previously discussed the issues with implementing taxes. Now we will discuss the three issues that comes with how the government goes about spending this money.

1. Recognition Lag

Fiscal policy relies on accurate economic data to inform decisions, but the process of recognizing changes in the economy is often delayed:

- Time Lag in Data: Policymakers depend on economic indicators, such as GDP growth rates or unemployment figures, which are reported with considerable delays. These indicators may not reflect the current state of the economy due to revisions or outdated data.

- Delayed Diagnosis: By the time an economic slowdown is officially identified, the opportunity for timely intervention may have passed, allowing the downturn to deepen.

2. Action Lag

Even once economic challenges are recognized, the process of enacting policy changes is time-consuming:

- Deliberation and Approval: Governments often face lengthy debates and bureaucratic hurdles before fiscal measures, such as increased spending or tax adjustments, are approved.

- Implementation Delays: Once approved, the actual rollout of infrastructure projects or disbursement of funds can take months, further delaying the intended economic impact.

3. Impact Lag

The effects of fiscal spending measures on the economy are not immediate:

- Time to Stimulate Growth: Investments in infrastructure or other large-scale projects take time to create jobs and generate income. Similarly, tax cuts or direct payments may take months to circulate through the economy.

- Miscalculation Risks: By the time the impact of fiscal spending is felt, the economic conditions that necessitated the intervention may have shifted, potentially leading to overspending or overheating of the economy.

Broader Implications

The cumulative effect of these delays can reduce the effectiveness of fiscal policy. For instance, if stimulus spending is implemented after an economy has already begun recovering, it may lead to inflationary pressures instead of addressing the original downturn. Conversely, delays in addressing economic slowdowns may exacerbate unemployment and reduced economic activity.

Critics argue that these lags, combined with political pressures and administrative inefficiencies, often undermine the timeliness and precision of fiscal spending, limiting its ability to stabilize the economy effectively.

Books Criticizing Fiscal Policy

The book A Monetary and Fiscal History of the United States delves into the interplay between monetary and fiscal policy over decades, highlighting periods when fiscal policy was seen as ineffective or counterproductive compared to monetary interventions. It critiques the inconsistencies and political influences affecting fiscal decisions.

The Limits of Fiscal Policy critically analyzes the limitations and unintended consequences of fiscal policy, especially in terms of economic growth and stability. Anthony discusses the lag effects and potential inefficiencies that make fiscal tools less effective than often claimed.

Fiscal Policy Cheat Sheet

Take a Quiz!

Check your proficiency level by taking our 10 question quiz below. Explanations will be provided at the end.

[ays_quiz id=’2′]